College Iowa Savings Fund Which is Very Interesting

College Savings Iowa 529 Plan. Saving ahead of time is one of the most significant things you can do to help make college a reality for a child and College Savings Iowa is here to help.

College Savings Iowa 529 In The News College Savings Iowa 529 Plan

It takes just 25 and 10 minutes to open an account online.

College iowa savings fund. College Savings Iowa is a traditional 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for qualified education expenses. Direct this Iowa 529 Plan can be purchased directly from the state. Sep 21 2020 539am.

And overseen by the Treasurer of the State of IowaThe plan offers four different age-based tracks that also take into consideration investors desired risk level along with 10 portfolios from which investors can choose up to five selections to make their own lineup of funds. Iowa has its own state-operated 529 plan called College Savings Iowa 529 plan. Iowa residents may enjoy a state tax deduction for contributions to the plan.

College Savings Iowa is a direct-sold 529 college savings plan available to residents of any state offering low fees and 14 investment options from Vanguard. The Treasurer of the State of Iowa sponsors and is responsible for overseeing the administration of College Savings Iowa. 529 Education Savings Plans.

It is sold directly to Iowans and people across the country. Iowa residents may enjoy a state tax deduction for contributions to the plan. In addition Iowa taxpayers can use the College Savings Iowa 529 Plan assets to pay for K-12 tuition with no Iowa state tax consequences as long as the student attends an elementary or secondary school in the state of Iowa which is accredited under Iowa Code Section 25611 and adheres to the provisions of the federal Civil Rights Act of 1964 and Iowa Code Chapter 216 or ii an elementary or secondary.

529 plan funds can be used at any accredited college or university across the nation including some K-12 private schools. Iowa residents may enjoy a state tax deduction for contributions to the plan. This is a 529 savings program thats managed by Vanguard Group Inc.

The College Savings Iowa is the name of Iowas 529 Plan. It is important to note that your child does not have to go to a IA college or university in order to use this savings account. Other state benefits may include financial aid scholarship funds and protection from creditors.

In 2006 Iowa introduced the IAdvisor 529 Plan. College Savings Iowa lets parents grandparents friends and relatives invest for college on behalf of a future scholar. This plan offers a variety of investment options including age-based portfolios that become more conservative as the child approaches college and static investment fund options.

Citizens and resident aliens with a valid Social Security or other taxpayer identification number. College Savings Iowa is a direct-sold 529 college savings plan available to residents of any state offering low fees and 14 investment options from Vanguard. DES MOINES The state program that allows parents and students to save for college is expanding the ways that money can be used.

Investors in the plan can withdraw their investment tax free to pay for qualified higher education expenses which include tuition books supplies and room and board at any eligible college university community college or. Although sponsored and administered by the Treasurer of the State of Iowa the plan is available to all US. GEAR UP Iowa vouchers can even be used to open a new College Savings Plan account.

College Savings Iowa is a 529 plan a tax-advantaged program intended to help an individual or a family pay the costs of higher education. College Savings Iowa is a direct-sold 529 college savings plan available to residents of any state offering low fees and 14 investment options from Vanguard. College Savings Iowa 529 Plan.

Since 1998 State Treasurer Michael Fitzgerald has been helping Iowans save for higher education and earn tax breaks at the same time. Vouchers are offered on a first come first served basis. College Savings Iowa offers an easy affordable tax-advantaged way to.

Jumpstart your savings today by registering your child for a chance to win a free College Savings Iowa contribution. College Savings Iowa was created in 1998 as Iowas first 529 plan. The funds offered include Vanguard.

State Treasurer Michael Fitzgerald says one change now allows College Savings Iowa funds to be used for qualified apprenticeship programs. Families can redeem one voucher per GEAR UP Iowa event and any relative or family member can set up and fund a College Savings Iowa. College Savings Iowa is an Iowa trust sponsored by the Iowa State Treasurers Office.

State Treasurer Fitzgerald Announces Increased College Savings Iowa Deduction Amount For 2021 News Iowatreasurer Gov

Iadvisor 529 Plan Iowa 529 College Savings Plan Ratings Tax Benefits Fees And Performance

How To Fit 529 Plans Into Your College Savings Strategy Forbes Advisor

Plan Highlights College Savings Iowa 529 Plan

Cost Of College College Savings Iowa 529 Plan

Plan Highlights College Savings Iowa 529 Plan

College Savings Iowa 529 Plan Home Facebook

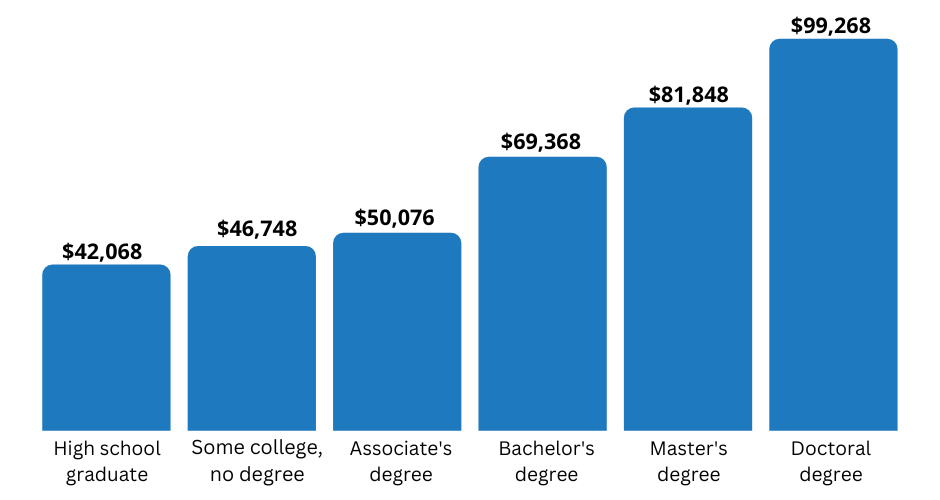

The Value Of A Degree College Savings Iowa 529 Plan

Plan Details Information Minnesota College Savings Plan

Iable Plan Iowa 529 College Savings Plan Ratings Tax Benefits Fees And Performance

College Savings Iowa 529 Plan Home Facebook

College Savings Iowa 529 Plan Home Facebook

Saving On Child Care Contribute To Your 529 College Savings Iowa 529 Plan

12 Benefits Of A College Savings Plan Iowa Student Loan

Iowa 529 Plan And College Savings Options College Savings Iowa

College Savings Iowa Iowa 529 College Savings Plan Ratings Tax Benefits Fees And Performance

College Savings Iowa Iowa 529 College Savings Plan Ratings Tax Benefits Fees And Performance

529 Plans The Best Places To Invest Your Education Savings Clark Howard

Post a Comment for "College Iowa Savings Fund Which is Very Interesting"